On October 25, 2024, Nvidia (NVDA.O) reclaimed its position as the world’s most valuable company, dethroning Apple (AAPL.O). This shift came after a remarkable rally in Nvidia’s stock, driven by overwhelming demand for its specialized artificial intelligence (AI) chips.

Record Market Valuation

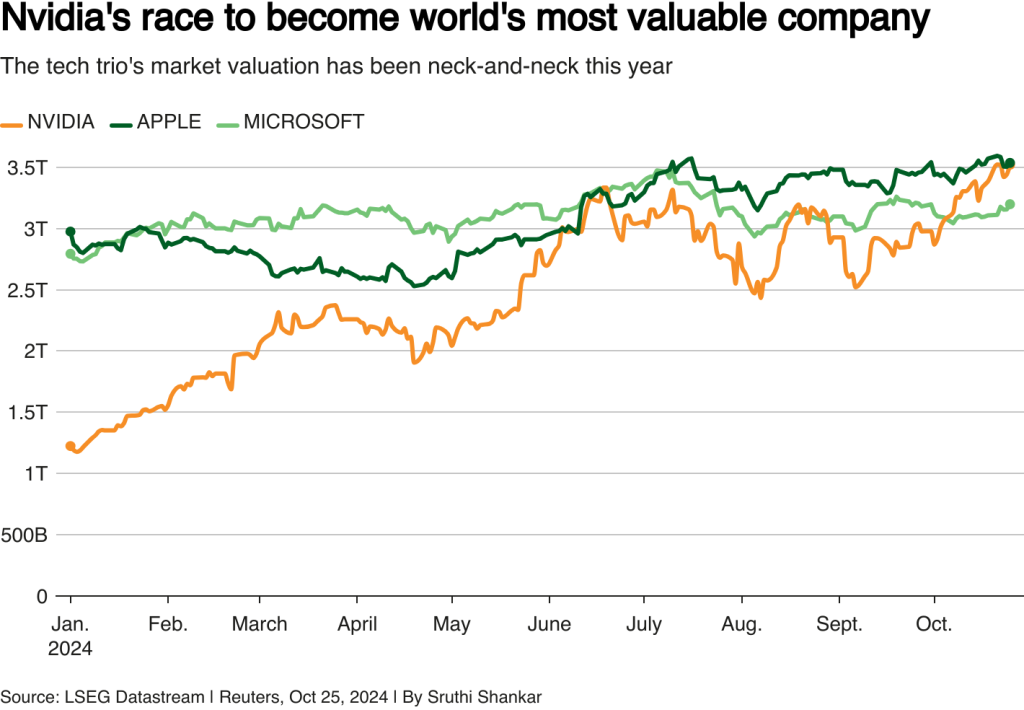

Nvidia’s market capitalization briefly reached an astonishing $3.53 trillion, edging past Apple’s $3.52 trillion, according to LSEG data. As of the latest trading session, Nvidia’s stock climbed 2.2%, giving it a market value of $3.52 trillion. Meanwhile, Apple’s shares increased by 0.9%, bringing its total valuation to $3.54 trillion.

A Competitive Landscape

In June, Nvidia had a brief reign as the most valuable company before being surpassed by Microsoft (MSFT.O) and Apple. For several months, these tech giants have been locked in a tight race, with their market capitalizations fluctuating close to one another.

Microsoft’s Position

Currently, Microsoft holds a market value of $3.20 trillion, with its stock rising 1.3%. This competitive landscape highlights the intense rivalry among the tech giants as they vie for dominance in emerging technologies.

Nvidia’s AI Dominance

Nvidia stands out as the leading supplier of processors crucial for AI computing. The company has emerged as the biggest benefactor in the competition among tech titans like Microsoft, Alphabet (GOOGL.O), and Meta Platforms (META.O) to harness the potential of AI.

Historical Context

Historically known for designing processors for video games, Nvidia has seen its stock surge approximately 18% in October alone. This spike follows OpenAI’s announcement of a substantial funding round of $6.6 billion, further fueling investor interest.

Boost from Western Digital

On Friday, Nvidia and other semiconductor stocks received a boost after Western Digital (WDC.O) reported quarterly profits that exceeded analysts’ expectations. This news enhanced optimism regarding demand in data centers, a key area for AI infrastructure.

Record Highs for Nvidia

Nvidia’s shares reached a record high on Tuesday, building momentum from a previous rally. The surge followed TSMC’s (2330.TW) impressive quarterly report, which highlighted a staggering 54% increase in profit, driven largely by the escalating demand for AI-related chips.

Apple’s Challenges

In contrast, Apple faces challenges with sluggish demand for its smartphones. iPhone sales in China fell by 0.3% in the third quarter, while rival Huawei saw its sales soar by 42%. This shift illustrates a growing competitive landscape for Apple.

Upcoming Earnings Reports

Apple is set to announce its quarterly results on Thursday. Analysts predict a 5.55% year-over-year revenue increase to $94.5 billion. In comparison, Nvidia is expected to report nearly 82% revenue growth, forecasting earnings of $32.9 billion.

Impact on the Tech Sector

The shares of Nvidia, Apple, and Microsoft significantly influence the technology sector and the broader U.S. stock market. Together, these companies account for approximately one-fifth of the S&P 500 index’s total weight.

Optimism in the Market

Market optimism about AI prospects, along with expectations for a decrease in U.S. interest rates by the Federal Reserve, has buoyed the S&P 500, which recently reached an all-time high. The positive sentiment is reflected in the stock prices of these tech giants.

Options Trading Surge

Nvidia’s remarkable stock gains have also heightened its appeal for options traders. The company’s options have become among the most actively traded, indicating strong investor interest and engagement in Nvidia’s future prospects.

Year-to-Date Performance

So far this year, Nvidia’s stock has surged nearly 190%, spurred by the explosion of generative AI and a series of optimistic forecasts from the company. This unprecedented growth underscores the changing dynamics within the tech industry.

Future Revenue Concerns

Rick Meckler, a partner at Cherry Lane Investments, raised questions about the sustainability of Nvidia’s revenue stream. He emphasized that the current excitement may stem more from investor sentiment than from tangible evidence supporting the long-term viability of AI demand.

Nvidia’s Confidence

Despite concerns, Meckler believes that Nvidia’s upcoming financial results are likely to impress investors. The company’s leadership is confident in its ability to meet market demands in the near term, further solidifying its position in the industry.

Tech Giants’ Strategic Moves

As the tech landscape continues to evolve, companies like Nvidia, Apple, and Microsoft are strategizing to secure their foothold in emerging markets. The ongoing battle for market share in AI technology remains fierce.

Investor Sentiment

Investor sentiment will play a crucial role in determining the future trajectory of these tech stocks. As companies continue to innovate, understanding market dynamics will be essential for predicting potential shifts in value.

The Road Ahead

As Nvidia and its competitors navigate this competitive environment, their ability to adapt and innovate will dictate their success. The focus on AI technology will likely continue to shape the market landscape in the months ahead.

Conclusion

Nvidia’s recent ascent to the top of the market highlights the significant impact of AI technology on investor behavior and market valuations. As competition heats up among tech giants, all eyes will be on how these companies respond to the evolving demands of the industry.

Viesearch - The Human-curated Search Engine

Blogarama - Blog Directory

Web Directory gma

Directory Master

http://tech.ellysdirectory.com

8e3055d3-6131-49a1-9717-82ccecc4bb7a

Viesearch - The Human-curated Search Engine

Blogarama - Blog Directory

Web Directory gma

Directory Master

http://tech.ellysdirectory.com

8e3055d3-6131-49a1-9717-82ccecc4bb7a